Dividend Download

Top dividend stocks & news

All about dividend investing

All about dividend investing

Want to make money? 💴

Try dividend investing.

What is it? It involves buying stocks that pay hefty dividends.

Who is it for? The strategy is said to be suitable for people interested in a regular flow of income.

🛑 A dividend is a distribution of profits by a corporation to its shareholders. When a corporation earns a profit or surplus, it is able to pay a portion of the profit as a dividend to shareholders. Any amount not distributed is taken to be re-invested in the business. Dividends are usually paid every quarter.

Warning ⛔️ : Dividends aren’t guaranteed. Just because a company is producing dividends doesn’t always make it a safe bet.

Which companies to invest in?

The dividend aristocrats—companies that have increased their dividends annually over the past 25 years—are often considered safe companies because they’ve stood the test of time.

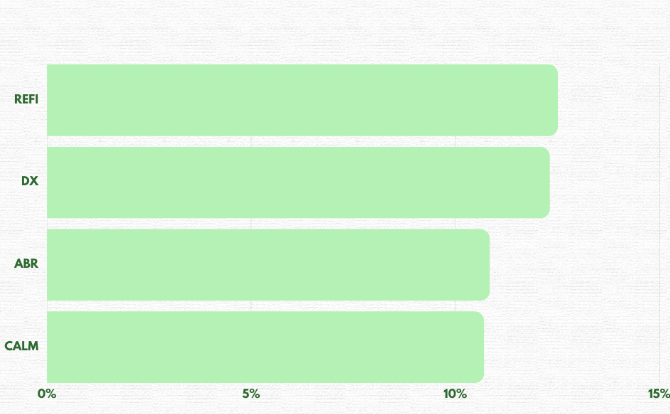

Here are some of the top aristocratic dividend stocks this year😀. We must mention this list keeps on changing every few weeks.

But stop 🛑 High yield is not always good – it might be a sign of distress. Companies in trouble often pay dividends to avoid negative news and avoid questions from investors.

🐰 Like a magician misdirecting with a poof of smoke while he pulls a rabbit out from behind the stage.

What to consider when choosing a company for dividend investing

Don’t just look at the yield because it may not be the best indicator.

Companies with long-term profitability and earnings growth expectations between 5% and 15%. But, again, remember that more is not always good. Companies with very high profitability often experience earnings disappointments, which almost always nicks the stock price.

Stay away from dividend-paying companies that are saddled with excessive debt. , i.e. avoid companies with high debt-to-equity ratios – anything above 2 is considered poor.

Don’t just look at the company but at the entire sector. A sector that’s set to boom might be a better investment. For example, the aging population indicates a boom for the healthcare sector.

How to start investing?

Here’s how:

☝️ The first step is to choose a stock you’re interested in.

👌 The next step is to decide how much you wish to spend.

👊 Next, add the stock to your portfolio and the dividend will get added to your account (automatically) whenever announced.

Income ETFs are designed to pay out dividends. Accumulation ETFs, however, do not pay a dividend.

Pros of dividend investing

Dividend investing offers a regular flow of income. It can be great for people who want to retire and enjoy a regular flow of cash. 💰

You enjoy double benefits because the stock may also appreciate over time, thus making you richer. 🤑

Dividend Reinvestment Plans (DRIPs) can help you make more money by reinvesting dividends and giving you a chance to take advantage of compound returns. 💴

Dividends provide a strong inflation hedge. This happens because top companies offer dividends that are typically higher than the rate of inflation. This is important in today's time when inflation is very high. 💷

Qualified dividends are taxed at a much lower rate; however, the rate depends on a variety of factors, including your location and total income. 🪧

Cons of dividend investing

Dividends are heavily taxed, especially when compared to growth stocks. In fact, they are first taxed when the company paying the dividend earns money. Next, they are taxed again when the investor receives dividends. Because taxes are due on dividend income when it is received. 😔 (Tip: Retirement accounts can help offset this)

Dividend stocks carry some risk as dividends aren't guaranteed and the company you have invested in may also falter. 😮

You cannot solely count on dividends since yield typically doesn’t go above 10%. 😭 The average dividend yield on S&P 500 index companies that pay a dividend historically fluctuates somewhere between 2% and 5%, depending on market conditions. However, as seen in the chart above, it may, at times, go high, but that is not promised.

Lastly, some economists argue that when a dividend is paid, it reduces the value of the stock by that amount because the company is distributing its cash, so dividend stocks underperform.

Resources

👩🏽⚖️ Legal Stuff

Nothing in this newsletter is financial advice. Always do your own research and think for yourself.