Dividend Download

Top dividend stocks & news

The Power of Dividend Reinvestment: Boosting Your Portfolio Returns

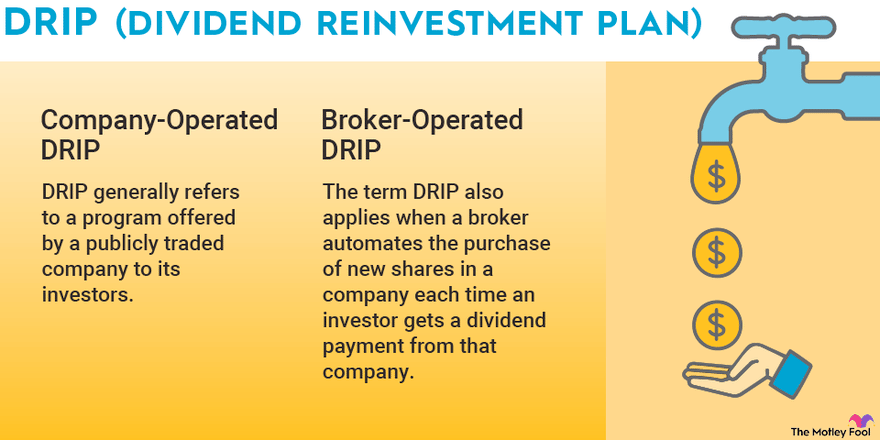

Dividend reinvestment plans, commonly known as DRIPs, offer investors a straightforward way to harness the power of compound interest. By automatically reinvesting dividends back into the stock that issued them, DRIPs allow investors to acquire additional shares—often fractional—without incurring transaction costs.

This passive strategy is particularly appealing for long-term investors who aim to maximize returns without constantly managing their portfolios.

Why DRIPs Are a Game-Changer

DRIPs are lauded for their simplicity and effectiveness. Reinvesting dividends ensures that your money continues to work in stocks you already believe in. This approach avoids the pitfalls of accumulating cash that may sit idle, potentially missing out on market gains.

For instance, over the 10 years ending December 31, 2024, the SPY (the largest S&P 500 exchange-traded fund) achieved a cumulative price return of 185%. However, with dividends reinvested through a DRIP, the total return soared to 239%—a significant boost driven by the compounding effect.

Key Benefits of DRIPs

Compounding Returns: Reinvesting dividends allows you to purchase additional shares, which in turn generate more dividends, creating a compounding cycle.

Passive Strategy: DRIPs automate the reinvestment process, reducing the need for active management and minimizing emotional trading decisions.

Cost Efficiency: Most brokerage platforms offer DRIPs without additional fees, making it a cost-effective way to grow your investment.

Who Should Avoid DRIPs?

While DRIPs are advantageous for many, they are not suitable for everyone. Investors who depend on dividend payments for regular expenses or those who prefer active management to allocate cash to new opportunities may opt out. Moreover, those needing near-term liquidity should also avoid tying up funds in volatile equities.

Learn from this investor’s $100m mistake

In 2010, a Grammy-winning artist passed on investing $200K in an emerging real estate disruptor. That stake could be worth $100+ million today.

One year later, another real estate disruptor, Zillow, went public. This time, everyday investors had regrets, missing pre-IPO gains.

Now, a new real estate innovator, Pacaso – founded by a former Zillow exec – is disrupting a $1.3T market. And unlike the others, you can invest in Pacaso as a private company.

Pacaso’s co-ownership model has generated $1B+ in luxury home sales and service fees, earned $110M+ in gross profits to date, and received backing from the same VCs behind Uber, Venmo, and eBay. They even reserved the Nasdaq ticker PCSO.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

Selecting the Right Dividend Stocks

Not all dividend-paying stocks are equal and you need to know how to pick companies with sustainable and growing dividends. Stocks with unusually high yields may signal underlying issues, such as declining stock prices or unsustainable payouts.

We recommend focusing on companies with a dividend yield of at least 0.25% and a quarter-over-quarter dividend increase of at least 15% over the past year. This approach ensures both income stability and growth potential.

To make it easier, we have selected some such names for you:

Oracle: With a modest 0.8% yield, Oracle has seen its stock rise 49% in 2025, driven by strong AI-driven revenue growth. Analysts project limited near-term upside but view it as a long-term AI winner.

American Homes 4 Rent: This real estate investment trust offers a 3.5% yield. Despite an 8% stock price decline in 2025, its strong funds from operations (FFO) guidance suggests resilience.

T-Mobile: Yielding 1.4%, T-Mobile’s stock has climbed 16% in 2025. Analysts remain optimistic, though secondary stock sales have tempered price targets.

These stocks exemplify the balance between dividend growth and capital appreciation, making them attractive for DRIP strategies.

Strategic Considerations for Dividend Investing

Incorporating DRIPs into your portfolio requires careful planning. Dividends play a critical role in total returns during volatile market conditions, such as those seen in 2025 amid tariff-related uncertainties.

Dividend-paying stocks can dampen volatility and provide a buffer against market downturns. However, investors must remain vigilant about the sustainability of dividends, as companies facing financial difficulties may cut payouts, undermining the DRIP strategy.

Practical Tips for Implementing DRIPs

Check Brokerage Options: Most platforms allow you to enable DRIPs with a simple setting. Verify that your brokerage supports fractional share purchases.

Evaluate Your Goals: Ensure DRIPs align with your long-term investment objectives and liquidity needs.

Monitor Dividend Health: Regularly assess the financial stability of your dividend-paying stocks to avoid companies at risk of dividend cuts.

Conclusion: Building Wealth Through Patience

As Charlie Munger famously said, “The big money is not in the buying or selling, but in the waiting.” DRIPs embody this philosophy by encouraging a disciplined, long-term approach to wealth-building.

By reinvesting dividends, investors can supercharge their returns, leveraging the power of compounding to achieve significant portfolio growth. Whether you’re a passive investor or seeking to diversify with stable dividend payers, DRIPs offer a compelling strategy to enhance your financial future.

👩🏽⚖️ Legal Stuff

Nothing in this newsletter is financial advice. Always do your own research and think for yourself.