Dividend Download

Top dividend stocks & news

Top Dividend Stocks Poised for Strong Performance in 2026: Realty Income and NextEra Energy

As 2025 draws to a close, dividend-paying stocks are gaining attention from investors seeking reliable income and stability amid evolving economic conditions. Declining interest rates throughout 2025 have already boosted these assets, and with the Federal Reserve signaling potential additional cuts into 2026, dividend stocks—particularly in sectors like real estate and utilities—appear well-positioned for continued outperformance.

Lower interest rates make fixed-income options like bonds less attractive, driving capital toward high-yield equities. Additionally, reduced borrowing costs benefit capital-intensive businesses such as real estate investment trusts (REITs) and utilities, lowering debt servicing expenses and supporting higher dividends and growth.

Two standout high-quality dividend stocks that exemplify this trend are Realty Income (NYSE: O) and NextEra Energy (NYSE: NEE). Both offer compelling yields, proven track records of dividend growth, and strong fundamentals, making them ideal for long-term investors focused on income and total returns.

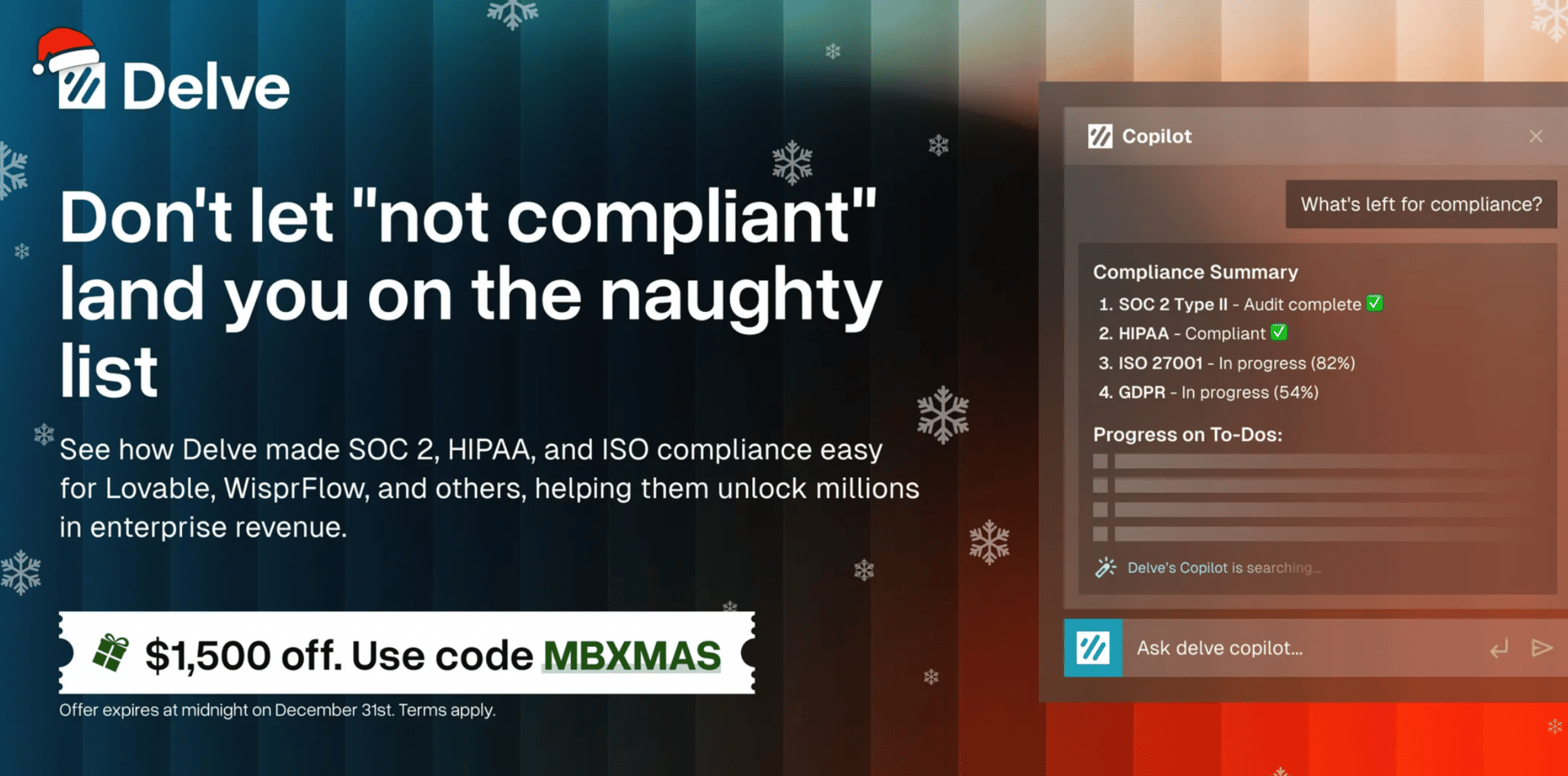

If Santa delivered gifts the way most teams handle compliance, everything would arrive in February.

That’s also when most Q1 deals slip, all because security reviews weren’t handled during the holiday downtime.December is the cheat month. Your buyers are offline, your calendar finally breathes, and it's the one time of year you can prep for audits without juggling 10 active deals.

Do it now, and January becomes “closed-won season” instead of “waiting-on-security season.”

Stay off the naughty list. Handle compliance while the world is quiet so your Q1 doesn’t get stuck in the chimney.

Delve is offering a $1,500 dollars off compliance here (best deal yet).

Make this your least stressful audit season yet.

Why Dividend Stocks Could Shine in 2026

The Federal Reserve has implemented multiple rate cuts since late 2024, bringing the federal funds rate down significantly by December 2025. While projections vary, many economists anticipate a cautious approach with possibly one or two additional reductions in 2026, depending on inflation and employment data. This environment favors dividend payers in two key ways:

Shift from Fixed Income: As bond yields fall, income-seeking investors rotate into stocks offering superior dividends, often pushing share prices higher.

Lower Financing Costs: Companies reliant on debt, such as REITs and utilities, benefit from cheaper borrowing, freeing up cash for dividends, acquisitions, and expansion.

Historically, dividend stocks have delivered superior long-term total returns compared to non-payers, especially during periods of moderating rates. With the S&P 500's average dividend yield hovering around 1.2%, selective high-yield names stand out even more.

Comparison of Two Premier Dividend Stocks

Here's an updated snapshot of Realty Income and NextEra Energy as of late December 2025:

Company | Dividend Yield | Market Cap | Key Growth Metric | 2025 YTD Stock Return (approx.) | Long-Term Total Return Example |

|---|---|---|---|---|---|

Realty Income (O) | ~5.7% | ~$55 billion | Adjusted FFO growth; monthly payouts | ~10-15% | Consistent annual increases for 30+ years |

NextEra Energy (NEE) | ~2.8% | ~$170 billion | EPS growth ~8%; renewable expansion | ~15% | Over 1,000% in past 20 years |

S&P 500 | ~1.2% | N/A | N/A | ~18-20% | Benchmark |

Spotlight on Realty Income: The Monthly Dividend Powerhouse

Known as "The Monthly Dividend Company," Realty Income is one of the largest net-lease REITs, owning over 15,000 properties across retail, industrial, gaming, and international markets. Its tenants—resilient essentials retailers like Walmart, Dollar General, and CVS—are largely recession-resistant, with no single tenant exceeding a small percentage of rent.

Unmatched Dividend Reliability: Pays dividends monthly, with increases for over 30 consecutive years and 112+ quarterly hikes in a row.

High Occupancy and Diversification: Near-99% occupancy and geographic/industry spread reduce risk.

Balance Sheet Strength: Investment-grade credit rating supports ongoing acquisitions.

With a yield significantly above the market average, Realty Income is perfect for investors prioritizing steady current income. Lower rates in 2026 could further enhance its ability to grow through property purchases.

Spotlight on NextEra Energy: Growth Meets Reliability

NextEra Energy, the nation's largest electric utility by market cap, combines regulated operations with leadership in renewables. Its Florida Power & Light subsidiary provides stable cash flows, while NextEra Energy Resources—the world's top renewable producer—drives expansion in wind, solar, and storage.

Solid Dividend with Growth Potential: Yield around 2.8%, backed by expectations of 6-8% annual EPS growth through the decade.

Renewable Tailwinds: Massive project backlog amid rising clean energy demand.

Defensive Yet Dynamic: Low volatility suits conservative portfolios, while growth offers upside beyond pure income.

NextEra appeals to investors wanting dividend safety plus capital appreciation, especially as utilities benefit from lower debt costs and energy transition trends.

Final Thoughts: Building a Resilient Portfolio

In an uncertain market, high-quality dividend stocks like Realty Income and NextEra Energy offer a compelling blend of income, stability, and growth potential. Realty Income excels for those needing immediate high yield and monthly payouts, while NextEra provides a lower-risk path to compounding returns.

Both companies boast elite management, conservative finances, and decades of dividend increases—traits that have historically rewarded patient investors. As rates potentially ease further in 2026, these names could deliver attractive total returns, making them strong candidates to buy now and hold long-term.

Thank you for subscribing to the Dividend Download!

If you need help with your newsletter, email our Arizona-based support team at [email protected]

👩🏽⚖️ Legal Stuff

FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY; NOT ADVICE.

Morning Download products and services are offered for educational and informational purposes only and should NOT be construed as a securities-related offer or solicitation or be relied upon as personalized financial advice. We are not financial advisors and cannot give personalized advice. There is a risk of loss in all trading, and you may lose some or all of your original investment. Results presented are not typical. This message may contain paid advertisements, or affiliate links. This content is for educational purposes only.

Please review the full risk disclaimer: MorningDownload.com/terms-of-use

Just For You: Become part of the Morning Download’s SMS Community.

Text “GO” to 844-991-2099 for immediate access to special offers and more!