Dividend Download

Top dividend stocks & news

The Power of Dividends: Why They Remain a Cornerstone for Long-Term Investors in 2026

Dividends often get overshadowed by flashy growth stories in bull markets, but history shows they deliver reliable, compounding returns—especially when capital appreciation slows.

Like reliable workhorses, dividend-paying stocks provide income, stability, and often better risk-adjusted performance than their non-paying counterparts. As we navigate 2026—with elevated valuations in tech-heavy indices, moderating interest rates, and retirees seeking sustainable yield—dividends deserve fresh attention.

This article explores their historical impact, key pitfalls, and why trends point to continued relevance.

The Compounding Engine: Dividends' Historical Contribution

Since 1960, reinvested dividends have driven the majority of the S&P 500's total returns.

Data shows that about 85% of cumulative gains from 1960 through recent years stem from dividends and their reinvestment, turning modest annual yields into powerful compounding. For perspective, a $10,000 investment in the S&P 500 in 1960, with dividends reinvested, would have grown dramatically more than price appreciation alone.

This chart (illustrating growth of $10,000 from 1960 onward, assuming reinvestment) highlights how dividends transform flat or modest periods into substantial wealth creation. Without them, long-term results would be far less impressive.

Attention Traders…

Every chart hides a moment when pressure builds, but you can’t see it without the right lens.

The Alpha Zone Indicator was built to expose that moment.

It tracks acceleration and compression across price, showing you where strength is forming in real time.

The result => faster reads, cleaner entries, stronger exits.

The Alpha Zone Indicator doesn’t guess. It measures.

Please review the full risk disclaimer.

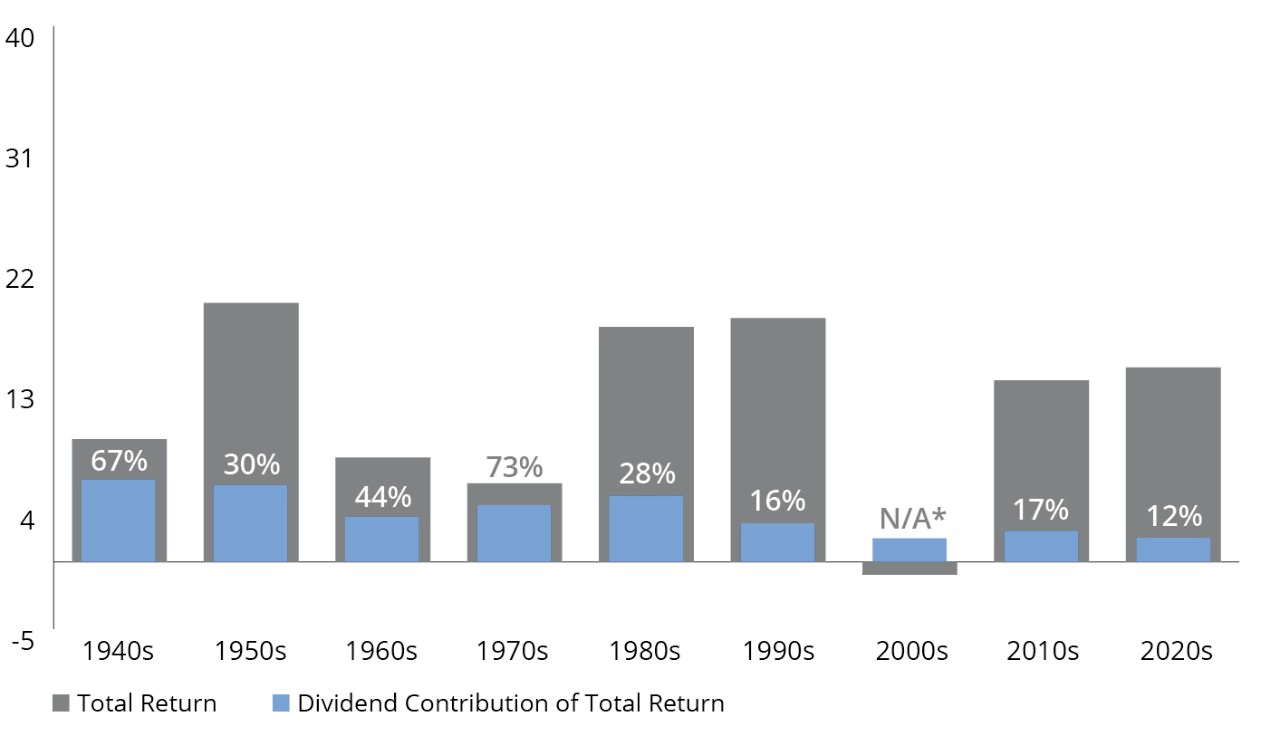

Decade-by-Decade Breakdown: When Dividends Shine Brightest

Dividend contribution varies by market environment. From 1940–2024 (and extending into recent data), dividends averaged around 34% of S&P 500 total returns. In lower-return decades (e.g., 1940s, 1960s, 1970s, where annualized returns were under 10%), dividends often provided 40–60% or more of gains. High-growth eras like the 1990s saw dividends play a smaller role as price appreciation dominated.

In "lost" periods—such as the 2000s, when the S&P 500 delivered negative total returns—dividends still generated positive annualized income (around 1.8%). This underscores their role as a buffer during volatility.

This decade-by-decade view shows dividends' outsized impact in tougher markets, reinforcing why they're not just for income but for resilience.

Yield Trends and the Pitfall of Chasing the Highest Payers

The S&P 500 dividend yield has fluctuated but remained relatively stable long-term, with a median around 2.9% from 1960–2024. It peaked in the 1980s, dipped in the 2000s tech boom, and sits near 1.15% as of early 2026—low by historical standards but supported by strong corporate earnings.

Chasing ultra-high yields can backfire. Studies (including Wellington Management's analysis since 1930) show second-quintile dividend payers (solid but not extreme yields) outperformed the highest quintile most often, beating the S&P 500 in seven of ten periods. Highest payers sometimes suffer from unsustainable payouts.

Payout ratios explain much of this: extreme payers averaged 75% of earnings on dividends (Russell 1000 data, 1979–2024), leaving little for growth or downturns. Moderate payers (around 40%) sustain and often grow payouts.

Dividend Policy Matters: Growers Lead the Pack

Ned Davis Research data (1973–2024) reveals a clear hierarchy:

Dividend growers/initiators: Highest returns (~10.24% annualized) with lowest volatility (beta 0.88, standard deviation 16.09%).

Steady payers: Solid ~9.20%.

Non-payers and cutters: Lagged significantly, with higher risk.

Growers signal confidence, strong fundamentals, and shareholder commitment—often leading to superior long-term performance.

Looking Ahead: Supportive Trends in 2026

Corporate balance sheets remain flush with cash (near-record levels post-GFC, though adjusted recently), and S&P 500 payout ratios hover low (~35–36% recently vs. historical 55%+ average), leaving room for increases. Retirees and institutions seek yield amid bond alternatives and demographic shifts. Institutional flows into equity-income strategies continue, potentially pulling retail investors along if growth sectors face headwinds.

In summary, dividends aren't flashy, but their track record—compounding, downside protection, and quality signals—makes them timeless. Focus on sustainable growers over yield chasers, and consider professional guidance to integrate them thoughtfully. In uncertain times, reliable income often proves the smartest edge.

Thank you for subscribing to the Dividend Download!

If you need help with your newsletter, email our Arizona-based support team at [email protected]

👩🏽⚖️ Legal Stuff

FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY; NOT ADVICE.

Morning Download products and services are offered for educational and informational purposes only and should NOT be construed as a securities-related offer or solicitation or be relied upon as personalized financial advice. We are not financial advisors and cannot give personalized advice. There is a risk of loss in all trading, and you may lose some or all of your original investment. Results presented are not typical. This message may contain paid advertisements, or affiliate links. This content is for educational purposes only.

Please review the full risk disclaimer: MorningDownload.com/terms-of-use

Just For You: Become part of the Morning Download’s SMS Community.

Text “GO” to 844-991-2099 for immediate access to special offers and more!